- Smashi Business

- Posts

- Property Prices Fall in Saudi; Qatar SWF Overhaul?; First IPO of 2026 in KSA

Property Prices Fall in Saudi; Qatar SWF Overhaul?; First IPO of 2026 in KSA

Thursday, January 22, 2026

Happy Thursday everyone!

World Economic Forum anywhere else than Davos? Dublin is an option being considered.

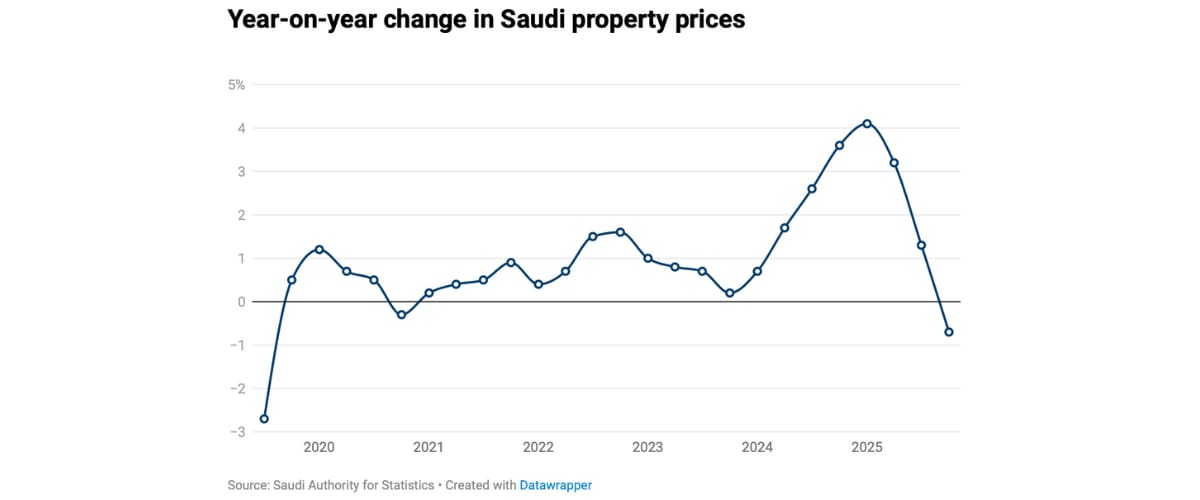

From the Arab world, our main stories today are: Qatar’s $580 billion sovereign wealth fund is weighing a structural split between its global and domestic assets, a move that could reshape how the state deploys its growing gas-driven surplus. In Saudi Arabia, property prices have fallen for the first time in five years following aggressive government intervention to curb housing costs and rental inflation. At the same time, the kingdom’s equity markets are reopening the IPO pipeline, with a quarry operator filing the first main-market prospectus of 2026 — a signal that dealmaking appetite is returning, selectively and strategically.

Qatar’s $580 Billion Wealth Fund is Planning to Separate Global And Domestic Assets

What’s it About?

Qatar Investment Authority (QIA) is considering a major restructuring that would separate its overseas investments from its domestic portfolio, according to people familiar with the discussions quoted by Bloomberg. The plan involves creating a new entity to hold and develop tens of billions of dollars in local assets, while allowing the main fund to sharpen its focus on global investments across sectors such as energy, finance and artificial intelligence.

Why it Matters?

If implemented, the overhaul would mark one of the most significant changes in QIA’s history and reshape how Qatar deploys its growing wealth. The move could improve capital allocation, build stronger domestic champions and enhance global returns as Qatar prepares for higher revenues from expanded gas production. It would also align QIA more closely with regional peers pursuing more specialized investment structures.

What’s Next?

Talks are ongoing and no final decision has been made. Any restructuring would likely unfold gradually as QIA continues expanding internationally, including a pledged $500 billion investment push in the US over the next decade. Observers will watch closely to see whether Qatar follows models set by Abu Dhabi and Saudi Arabia in turning state-backed assets into globally competitive platforms.

Additional read: Qatar wealth fund commits $25B to Goldman investments

Markets

EGX 30 | 46,011.98 | 0.23% |

DFMGI | 6,397.34 | 0.346% |

ADX | 10,205.71 | 0.097% |

Tadawul | 10,948.19 | 0.33% |

Saudi Property Prices Fall For First Time In Five Years After Government Intervention

What’s it About?

Property prices in Saudi Arabia have declined for the first time in five years, official data shows. The real estate price index fell 0.7 percent in the final quarter of 2025 compared with a year earlier, driven mainly by a 2.2 percent drop in residential prices. The decline marks the steepest quarterly fall since 2019 and the first contraction since late 2020.

Why it Matters?

The fall reflects the impact of aggressive government measures to rein in housing costs, which have been a major source of inflation. Rents rose 8.2 percent last year, making housing the biggest inflation driver and prompting Crown Prince Mohammed bin Salman to label price increases “unacceptable.” Rising affordability pressures have also led to more tenants struggling to meet rent payments.

What’s Next?

Authorities are expected to maintain pressure on the property market through tighter regulations. Measures already in place include a five-year rent freeze in Riyadh, higher taxes on undeveloped “white land,” and auctions of large vacant plots to smaller buyers. Analysts will watch whether these steps lead to a sustained correction or simply slow price growth in 2026.

Quarry Operator Files Saudi Arabia’s First IPO Prospectus Of 2026

What’s it About?

Construction materials firm Saleh Abdulaziz Al Rashed & Sons has become the first Saudi company of 2026 to publish an IPO prospectus for the main market. The quarry operator plans to sell 5.58 million shares, representing 30 percent of the company, following CMA approval received last year, with book-building and subscriptions running in early February.

Why it Matters?

The listing signals continued momentum in Saudi Arabia’s capital markets after nearly $4 billion was raised through IPOs last year. It also highlights investor interest in infrastructure-linked businesses as the kingdom ramps up spending under Vision 2030, with mining and construction materials playing a growing role in economic diversification and large-scale development projects.

What’s Next?

The share sale is scheduled for mid-February, with final allocations expected on February 24, while a listing date has yet to be announced. Attention will also turn to other IPO candidates, as foreign investor restrictions ease next month and several CMA-approved companies weigh market entry in the months ahead.

🦄 World of Startups

NVSSoft’s Tarasol Joins Elite Group with Saudi Accreditation Success

Halo AI Boosts Brand-Creator Collaborations, 118% Spike in Sales After Major Update

Oman’s eMushrif Secures $7.5M to Expand Smart Transport into Saudi and UAE

NEOM’s Level Up Backs Five Saudi Startups in Gaming Expansion Push

Wadi Jeddah and Pure Advance Join Forces to Boost Saudi Innovation Ecosystem

HSBC and Presight Forge AI Partnership to Revolutionise Banking in UAE

👨💻From Smashi Business’ Desk

UK Billionaire John Fredriksen Finally Spotted in Dubai, Hosted by DMCC Boss

Mona Kattan has shared a Message of Solidarity with the People of Iran

Egypt’s $35B Gas Deal with Israel Faces Uncertainty as New Clauses Favor Israeli Supply

Uber’s Khosrowshahi: Major Companies Will Invest Aggressively in Iran After Regime Change

Tunisian Filmmaker Zoubeir Jlassi Wins $1M AI Film Award at 1 Billion Followers Summit

🔍In other news…

🗓️ Plan Your Events (Jan-Feb 2026)

UAE

21-27 January: Emirates Airline Festival of Literature, Dubai.

21-24 January: Acres Real Estate Exhibition, Expo Center, Sharjah.

31 January-February 1: Sharjah Entrepreneurship Festival (Media Partners)

3-5 February: The World Governments Summit, Dubai.

9-12 February: World Health Expo (WHX), Dubai.

11-12 February: STEP Dubai Conference, Dubai Internet City. (Media Partners)

Saudi Arabia

28-30 January: Jeddah International Travel and Tourism Exhibition (JTTX), Jeddah.

2-4 February: Saudi Media Forum, Riyadh.

2-4 February: Women Leaders Summit and Awards KSA, Riyadh.

8-12 February: World Defense Show, Riyadh International Convention and Exhibition Center, Riyadh.

Egypt

5-7 February: RiseUp Summit, Cairo. (Media Partners)

11-12 February: Ai Everything Egypt (Organized by GITEX Global), Cairo. (Media Partners)

Qatar

1-4 February: Web Summit Qatar, Doha. (Media Partners)

2-5 February: 21st International Conference & Exhibition on Liquefied Natural Gas (LNG2026)